Various initiatives have been undertaken by the Ministry of State-Owned Enterprises (BUMN) to improve the implementation of corporate governance in SOEs. The launch of the values that serve as the basis for SOE management, namely AKHLAK (Integrity, Competence, Harmonization, Leadership, Accountability, and Customer-oriented), is a strategic step in the transformation of SOE culture, including creating awareness about risks.

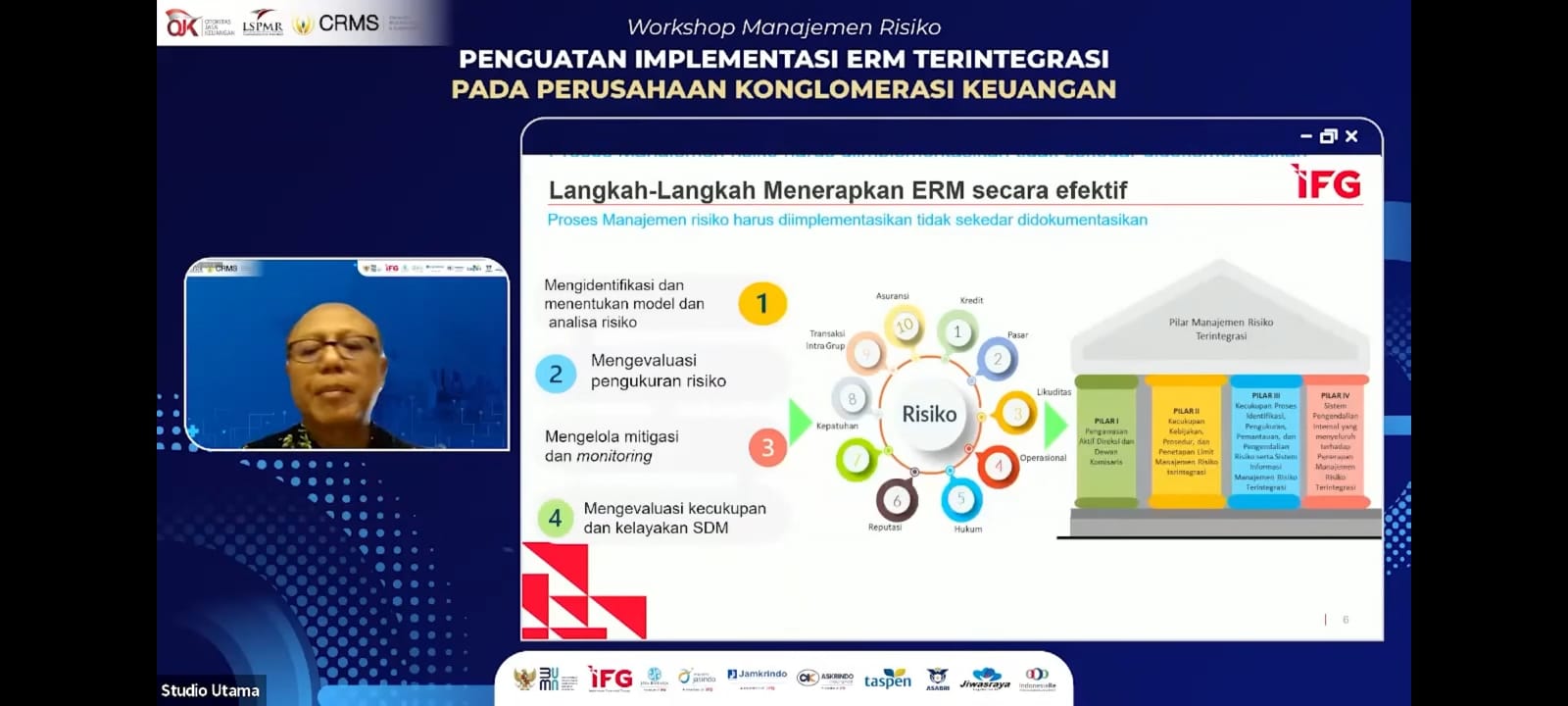

As part of its collaboration and synergy to strengthen the integrated aspects of Enterprise Risk Management (ERM), the Insurance and Pension Fund Cluster initiated a workshop titled "Strengthening ERM Implementation in Financial Conglomerates" on Thursday, February 24, 2022. PT Jamkrindo, as the Chair of the GRC Workstream for the BUMN Insurance and Pension Fund Cluster, also hosted the event.

The workshop featured several key speakers to share their knowledge, including Dwi Ary Purnomo, Assistant Deputy for Risk Management and Compliance at the Ministry of SOEs, who delivered the opening speech; Dewi Astuti, Head of Non-Bank Financial Industry Supervision Department 1A at OJK, who gave the keynote speech; and other speakers such as Bambang W. Budiawan, Head of the Non-Bank Financial Industry Supervision Department 2B at OJK; Antonius Alijoyo, Founder & Principal of CRMS Indonesia; and Hexana Tri Sasongko, Deputy President Director of PT Bahana Pembinaan Usaha Indonesia (Persero) or IFG.

Dewi Astuti, Head of the OJK Non-Bank Financial Industry Supervision Department 1A, expressed her appreciation for the workshop organized by the Insurance and Pension Fund Cluster. She highlighted that the pandemic has directly and indirectly increased the exposure to risks, including credit, market, operational, and strategic risks. Therefore, the ability to manage risks effectively is essential.

"The increase in non-bank financial institutions' business activities with increasingly complex risks needs to be matched with the implementation of adequate, effective, and measurable risk management. This risk management should not only serve the interests of the non-bank financial institution but also those of the public using its services," she said.

She also elaborated on the benefits of applying risk management for non-bank financial institutions (LJKNB), including insurance companies and the general public. These benefits include the ability of companies to better identify, measure, control, and manage risks in their business operations. Furthermore, it ensures that businesses comply with legal regulations, standards, principles, and sound business practices.

Bambang W. Budiawan, Head of the OJK Non-Bank Financial Industry Supervision Department 2B, added that the application of risk management in a conglomerate context should be viewed holistically and contextually, as each company within a holding group has its own complexity, inherent risks, and material risks. "This requires a holistic analysis and thinking," he said.

Dwi Ary Purnomo, Assistant Deputy for Risk Management and Compliance at the Ministry of SOEs, stated that the Ministry of SOEs is continuously undergoing a comprehensive transformation. He emphasized that risk management is a priority in this transformation agenda.

"Risk management is a critical aspect. The Ministry of SOEs is currently drafting risk management guidelines, which include strengthening the roles of the Board of Commissioners and supporting organs as integral components," he added.

Hexana Tri Sasongko, Deputy President Director of PT Bahana Pembinaan Usaha Indonesia (Persero) or IFG, emphasized that integrated ERM is a priority for IFG this year. The company is focused on building prudent governance and robust risk management.

"Risk management should not be a stopper but a business enabler. Risk awareness will guide us to make informed decisions on acceptable risks. Management must implement risk management, not just measure it, but control it," said Hexana.